Past Articles

Continue Reading

Website Liability, Anyone? How to Keep Your Online Presence Protected

Website liability is an extension of the ages old accountability for what you say or write. Such responsibility extends to household members, so it's important to be aware of what a family's little E-wizard may be doing.

Continue Reading

Are Your Grown Kids Properly Covered? How to Make Sure You, Your Adult Children, and Your Property are Safe

Blood may be thicker than water, but it is thinner than insurance contracts. An adult son or daughter may think that, when a loss happens, coverage is available from mom or dad's homeowners or auto policy. It usually isn't, and finding this out after a loss is an unpleasant experience.

Continue Reading

Liquor Liability Coverage: How to Protect Your Business from Losses Related to Alcoholic Beverages

Many businesses have the majority of their exposures against lawsuits covered by a general liability policy. However, business owners and managers often overlook their responsibility for losses related to alcoholic beverages.

Continue Reading

Workers Compensation: What Is It and What Does It Mean for Your Insurance Needs?

The workplace is an extremely common setting for a person to be injured. The Workers' Compensation and Employers' Liability Insurance Policies are used to provide insurance coverage for a company's statutory liability (coverage responsibility) under the Workers Compensation Act.

Continue Reading

Special Property, Special Coverage

A standard homeowners policy offers a limit equal to half of the amount reserved for the residence to protect against loss to a given residence's personal property (ex. Your home is covered for $150,000, so your contents and furnishings are covered for $75,000).

Continue Reading

Identity Theft - What Is It, and How Can You Make Sure You Are Protected?

ID theft describes any dishonest and unauthorized use of private information. In the past, the term rightfully described forgery or passing oneself off as another person to trick someone out of money and/or property.

Continue Reading

Earthquake and Volcanic Eruption - Do You Have the Coverage You Need If Your Property is Damaged or a Total Loss due to a Natural Disaster?

Have you thought about what you would do if a natural disaster happened to you? Do you know if your insurance policy would cover your property if it's damaged or a total loss because of the disaster?

Continue Reading

Hobby or Business - Whether It’s for Fun or for Profit, It Can Seriously Impact Your Insurance Needs

Your hobby may significantly affect your insurance needs. Hobbies often require a large investment in tangible property and may even create some legal responsibility to other persons or their property.

Continue Reading

Insurance Fraud: How Fraud Greatly Affects the Insurance Sector While Consumers Often View the Problem as Less Serious

Fraud always plagues the insurance sector, while insurance consumers often view the problem far less seriously. There is a similarity in how individuals view tax fraud.

Continue Reading

Did you receive some nice and meaningful jewelry this Christmas? Learn how to protect your priceless valuables.

Most homeowner policies provide minimal coverage for jewelry. The reason? Jewelry is high-valued (especially concerning its size), is easily lost or destroyed, and is vulnerable to theft (as well as fraud).

Continue Reading

(Un)Score Insurance Through Credit Score: What To Do If Your Insurance Is Being Affected By Your Credit Score

Insurance companies use different sources of information about a person that supplements an application. For auto coverage, motor vehicle reports are ordered. For home coverage, physical inspections may be needed.

Continue Reading

Battling Burglary: How to Protect Your Property and Your Privacy from Pilfering Persons

Few things give a property owner a sicker feeling than coming home and finding a door that was locked and closed is damaged and ajar. Dreading taking any action, the door is opened and entered and there is the chaos and loss caused by burglars.

Continue Reading

Headed Out For A While? Learn About Protection for Your Vacant or Unoccupied Home

An unoccupied home is a temporary condition and an exception to a residence normally having occupants, like vacations. A vacant home generally represents an abandonment of property. Either condition may affect your coverage under a typical homeowner policy.

Continue Reading

Dealing with Indirect Loss: How to Prepare Your Business for the Unexpected

A business owner wants to protect company assets, and one way they achieve this is by handling direct threats to buildings, equipment, office furniture, etc. However, there is another area of concern that is critical for survival - addressing indirect threats.

Continue Reading

Protect the People at Your Home for the Holidays! How to Ensure the Guests at Your Holiday Party Are Safe During the Event and After They Leave

The holidays are rapidly approaching, and many people are looking forward to celebrations that include friends and family from across the country. Food, fun, conversations, and spirits will flow generously.

Continue Reading

Got a Gig? If You’re a Performer, Make Sure You and Your Property Are Covered When Performing

From the smallest towns to the largest cities, there's the repeated scene of a bar or club filled with people. They gather to eat, drink, and to be entertained (usually) by one of three popular sources: live bands, DJs, and karaoke. While many performers who provide these services do so full-time, the vast majority don't. In fact, many such performers treat their activities as hobbies instead of businesses, and that can create problems.

Continue Reading

Heading to a Tailgate? Make Sure You’re Covered From the Possibilities of What Could Go Wrong

Autumn is known for its colors - the changing of the leaves, the in-season plants that grow, and the masses that gather outside football stadiums each weekend wearing jerseys and other paraphernalia in support of their favorite teams.

Continue Reading

Don’t Fan the Flames! How To Stay Safe While Enjoying Your Fire Pit

Many homeowners love to use fire pits as a simple and effective way to enhance the looks and usefulness of their outdoor spaces. Great for entertaining during the cooler days and nights of spring and autumn, it’s no wonder these items have grown increasingly popular.

Continue Reading

Can You Escape the Liabilities? How To Have Fun and Stay Safe When Hosting An Escape Room

Over the past few years, a trendy new activity has swept the nation. A popular form of entertainment for family and friends, as well as a team building method used by many businesses, escape rooms are an exciting way for a group to work together.

Continue Reading

Joining the Neighborhood Carpool This School Year? Make Sure You Have the Coverage You Need!

Environmental concerns, traffic congestion, convenience, desire to relieve driver stress, poor public transportation, and lack or expense of parking are all factors that contribute to commuters forming driver groups or carpools.

Continue Reading

Are Your Academic Activities Covered? Why You Should Consider Educators' Legal Liability Insurance for Your Academic Organization

Educators' Legal Liability Insurance handles loss that is directly involved with the academic activities of private or public colleges, universities, high schools, or even trade schools.

Continue Reading

In-Home Daycares and Schools: Make Sure You Have the Coverage You Need to Protect You, Your Home, Your Students, and Your Employees

A variety of businesses are routinely operated in homes. Many home-based businesses affect little more than the homeowner and other residents, but some businesses that operate from a home directly affect many other people.

Continue Reading

Who Doesn’t Love A Treehouse? Kids, Parents, and Neighbors All Recognize the Great Fun a Treehouse Provides, But Your Insurance Agent Is Unconvinced

Treehouses are the epitome of childhood fun. They are clubhouses, hideaways, castles, war rooms, forts, spaceships, control centers, submarines, and more. The use of a treehouse is limited only by imagination.

Continue Reading

Interested in Renting Pools or Tools? What You Need To Know About Participating in the Sharing Economy

The internet is relentless in finding ways to maximize the sharing of resources, and the creation of online/mobile platforms that match buyers with sellers has made this process more streamlined and much easier.

Continue Reading

You Know The Grill! How To Keep People and Property Safe While Cooking on a Grill This Summer

During summertime, millions of households regularly take advantage of the pleasant, warmer weather by cooking meals outside, specifically on the grill. While this is generally seen as a fun and relaxing activity, it can also represent a serious source of property damage and injury.

Continue Reading

Is Your Boat Protected on the Water and in the Harbor?

The insurance approach for covering boats and boating property is similar to the approach used to protect cars and homes. Essentially, insurance is offered on a package basis, meaning that there is coverage for physical property and protection against the legal and financial consequences of injuring others or damaging property that belongs to others.

Continue Reading

Is Your Summer Fun In Danger? How Lacking Safety Precautions and Proper Liability Coverage Can Ruin Any Summertime Activity

With sunny days, warm weather, and ample free time, our daily lives see a huge surge in recreational activity during the summer. Parents don’t want their kids inside staring at screens all day, so they find leisurely and recreational activities for themselves and their children to enjoy. These activities range from family vacations and summer camps to backyard sports games and neighborhood pool visits. Some families may even purchase passes to recreational facilities, such as parks or community centers, during the summer.

Continue Reading

Pros and Cons of Dogs in the Workplace: How It Can Help, How It Can Hurt, and How You Can Be Protected

Dogs at work have become a welcome new benefit for employees. According the scientific studies, dogs help reduce stress, anxiety, and depression. This means that allowing employees to bring their dogs to work could actually benefit employers and business operations.

Continue Reading

Be Prepared To Overcome Catastrophe: Protect Your Business from Interruptions to Normal Operations with a Disaster Recovery Plan

No business wants to face an event that could seriously curtail or even shut down operations, but the unfortunate reality is that few businesses have plans to deal with such a disaster. It is not unusual for a business to overlook creating disaster plans. Further, companies that do have disaster or continuity plans in place often fail to update their plans on a regular basis.

Continue Reading

How to Protect Your Contracting or Construction Business from Equipment Theft: What You Need to Do and How We Can Help You

Building and Construction work is an expensive business. From labor costs, the fluctuating prices of building materials, and more, contractors must consider many things when evaluating their expenses. One of the most costly yet most important parts of the budget lies in the equipment and machinery a construction company requires.

Continue Reading

What Should Professional Liability Look Like for Architects and Engineers?

Architects and engineers are highly trained professionals who provide advice and services to individuals, businesses, and governments about a very wide variety of issues related to building, design, and construction.

Continue Reading

How to Avoid Ugly Losses in the Beauty Industry.

Barber shops and beauty salons offer a wide range of services, which traditionally include hairstyling, shaping eyebrows, applying cosmetics, permanent waving, shampooing, tweezing, facial shaving, trimming, plucking, bleaching and dyeing, manicures, hair tinting, waxing or hair removal, and pedicures — to name a few.

Continue Reading

E-scooters: A Change for the Better, or Just Another Liability Concern?

E-scooters are a natural outgrowth of ride-sharing and a concern to find more eco-friendly transportation. Several companies, such as Spin, Lime, Scoot, and Bird, have targeted locales with dense populations and traffic issues…

Continue Reading

How to Protect Your Business from Social Media Liability Claims.

Your chances of suffering a loss are increasingly affected by your use of the Internet and, particularly, social media. Increasing your awareness of social media liability loss exposures may help you to minimize or avoid them.

Continue Reading

Don't Lose Focus after a Vehicle Accident: Help the Injured and Then Grab Your Camera!

While pictures are better than verbal and written accident descriptions, it is best to have a photographic strategy in order to gather visual accident information to protect against any possible liability resulting from the accident.

Continue Reading

How to Avoid Accidental Identity Theft after an Auto Accident.

Instead of limiting our information to just the names, license numbers and insurance companies, drivers now trade more details than is necessary. Sensitive and even private information that can put you or your family at risk is now being readily shared through a mobile device…

Continue Reading

Hobby or Business? Make Sure You Are Protected.

We all have hobbies, but have you ever considered whether your hobby affects your insurance needs? Quite often, these hobbies could require a large investment in relevant property, and in some cases, can even require legal responsibility.

Continue Reading

How to Handle A Commercial Auto Cellular Distraction

If you operate a commercial fleet, then you know how important it is to be minimizing accidents and risks from drivers. When an accident occurs, it causes a wide range of issues for a business, from the interruption of work to substantial property loss.

Continue Reading

Property Concerns to Consider When Working From Home.

Since the COVID-19 pandemic took hold, there has been a significant increase in people working away from the traditional office setup. As the government enforces social distancing, working from home (WFH) is now a necessity for many employees, reducing the opportunities for the virus to spread.

Continue Reading

The Rise of the Smart Car.

In recent years, technology has completely transformed the world that we live in, and the automotive industry is not different. Do you remember the first time you got behind the wheel of a car? From that very first time in the driver's seat, safety has been drummed into us.

Continue Reading

The Teen Text Mess: The Rising Issue of Texting While Driving

For teenagers and young people, learning to drive is their chance to gain their independence and discover the world more easily. However, recent research has shown that young female drivers are now just as dangerous behind the wheel as their male counterparts, particularly when it comes to texting while driving.

Continue Reading

Should You Get Insurance for Your Wine Collection?

Millions of people across the United States enjoy drinking a glass of wine. No matter whether it is at the end of a stressful day or over dinner, its popularity has never been more popular, even amid the growing boom of craft beers.

Continue Reading

What You Need to Know about the Different Types of Personal Injury.

Unlike accidental events that result in a person suffering a serious injury (called bodily injury) or property that is damaged or destroyed (called property damage), personal injury usually involves one person's alleged interference with another person's legal rights. It also applies to incidents that harm another person's reputation.

Continue Reading

What Is a Dangerous Workplace?

Work is an essential part of life. Having a well-paid job ensures we are able to meet the basic necessities of life such as eating and enjoying shelter; it can also help provide a level of comfort and healthcare. We all spend a long time at work, and many of us can take our workplace surroundings for granted.

Continue Reading

Are You Covered During Your Office Christmas Party?

The festive season is upon us, which means you might well be thinking about organizing an office Christmas or New Year's Eve celebration or have been invited to a client party. With the festive cheer and alcoholic beverages being consumed, there are many questions that arise…

Continue Reading

Controlling Rising Auto Insurance Premiums.

Car insurance is something that every road user needs to have. However, in recent years, many policyholders have become frustrated with the rising costs of car insurance premiums. There are a number of factors behind these rises, but some of the most common reasons include…

Continue Reading

Insuring for the Modern Smart Home.

For a long time, the primary difference between new and old homes was an aesthetic appeal. While the materials used in the construction would remain the same, the layout and features would change according to trends. From the space of the room to the prominence of core rooms such as the bathroom and kitchen, each home builder would tailor the construction to suit the overall cost of the finished property.

Continue Reading

Is a Business Owner Policy Right for You?

If you own and/or run a smaller business, your insurance needs may be properly handled by a businessowner policy (BOP). A BOP is a single form that offers both property and liability protection. Retailers, wholesalers, small contractors, artisan contractors, dry cleaners, restaurants, offices and convenience stores (including those with gas pumps) are eligible for BOP coverage.

Continue Reading

What Are the Two Types of Home Office Insurance?

Once considered a luxury for many people, 2020 has seen working from home become the new normal for millions of people across the globe. As the COVID-19 pandemic took hold and social distancing became commonplace, many people were forced to begin working remotely…

Continue Reading

Shoot! You Were Just in an Accident, Now What?

Most times after an accident, the drivers and passengers of vehicles are shaken up and it can be hard to remember what to do next.First, a reminder to be sensible with your priorities. After an accident, the biggest issue is everyone's safety, including assisting with injuries, as well as getting everyone out of harm's way. Remember, people first, and then worry about getting accident information.

Continue Reading

Lawyers' Professional Liability

Attorney-client relationships come with a multitude of professional responsibilities. A law office's Commercial General Liability Insurance policies carried for ownership, maintenance or use of their premises specifically excludes coverage for claims arising from professional errors and omissions. That "coverage gap" is addressed through a Lawyers' Professional Liability Insurance policy.

Continue Reading

Saving For Your Child's College Fund.

Starting at a very young age, everybody asks you what you want to be when you grow up. From the moment we are young, the wheels of what we should do in life begin. Most of us spend our formative years carefree and excited about our futures and then BAM — reality hits. Life is expensive.

Continue Reading

How Does the Fair Plan and DIC Work Together?

If you are a homeowner in California you have seen your homeowner's insurance rates increasing over the last couple of years, sometimes dramatically and even without having filed a claim. One of the major reasons for this has been the devastating wildfires that have plagued our state over the last couple of years.

Continue Reading

Some Boating Myths Debunked.

Driving a Boat is the same as driving a car. No it is not! Boats float on top of the water and generally the water is always moving. Boats cannot simply maneuver as precisely as a vehicle can on asphalt. Boats have no brakes, and even if they did have brakes you still have the movement of the water as well as wind playing a factor in moving you about.

Continue Reading

Volunteers Need Protection During COVID-19

We at Williams Co. Insurance Brokers applaud volunteers, particularly so at this time with such vastly increased need following the onset of the COVID-19 virus. Non-profits play an important role in the communities in which they serve, and without volunteers, many critical needs would be unmet.

Continue Reading

Your Relationship With Your Insurance Agent - And Why Its' Important

The personal relationships we have with the people in our life are imperative to build positive mental and emotional health. These important relationships not only include our family and friends but also our work colleagues, neighbors, and other groups that contribute to our identity.

Continue Reading

How Are Insurance Companies Responding to COVID-19?

Customers who are driving less want to know how their personal auto insurance will be impacted by Covid-19. Many insurance companies like Mercury, Travelers, Nationwide and Safeco are voluntarily returning either a percentage of premiums or a flat amount refund as a result of fewer losses due to the reduced traffic.

Continue Reading

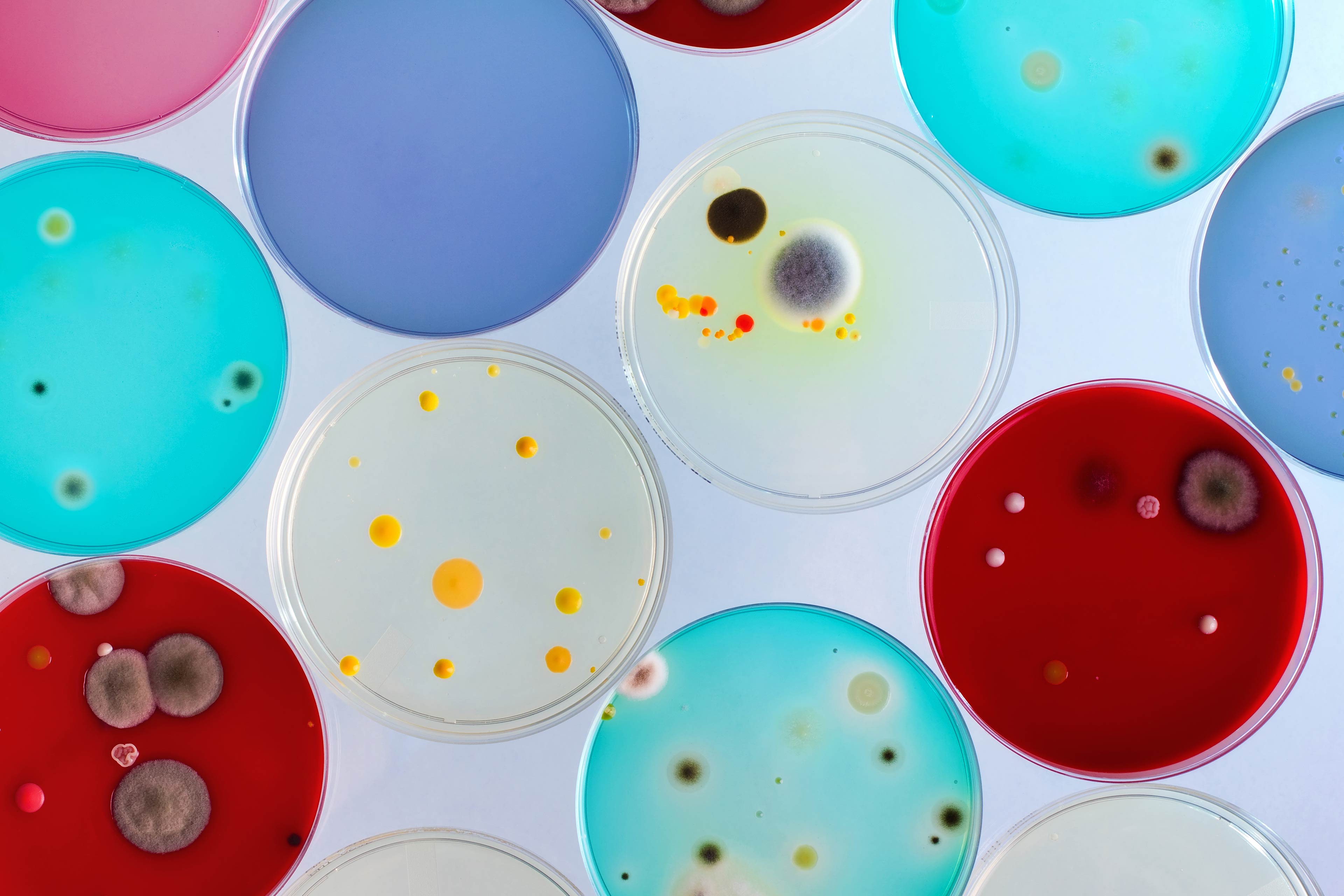

Why is Cyber Liability worth it?

A lot of companies are under the impression that their Commercial General Liability (CGL) insurance will cover cyber exposures. Now where there is limited coverage under the CGL with the right endorsements, the coverage is inadequate. The coverage is not board enough to try handle cyber exposures. It is best to view cyber liability as a type of catastrophic coverage if something where to happen that the company would have a hard time recovering from.

Continue Reading

What Is Term Life Insurance and Who Needs It?

Term life insurance is a life insurance policy that provides death protection coverage at a fixed rate for a selected period of time. Simply, if you have a term policy and you die within that term, your beneficiary will receive the payout.

Continue Reading

What Is Insurance and Why Do You Need It?

Insurance can often be a complicated topic for many, filled with contract and legal jargon that is hard to decipher. But at its core, it's about Risk. How much of the risk are you willing to keep for yourself, and how much of the risk can you transfer to someone else.

Resources

We can help with any of your insurance needs, providing personal, commercial, life, and health insurance policies and advice.

Get a QuoteGet in Touch

Contact Us

Phone: (714) 526-5588

Fax: (714) 526-4487

Email: info@williamsinsurance.com

Our Location

609 N. Harbor Blvd.

Fullerton, CA 92832