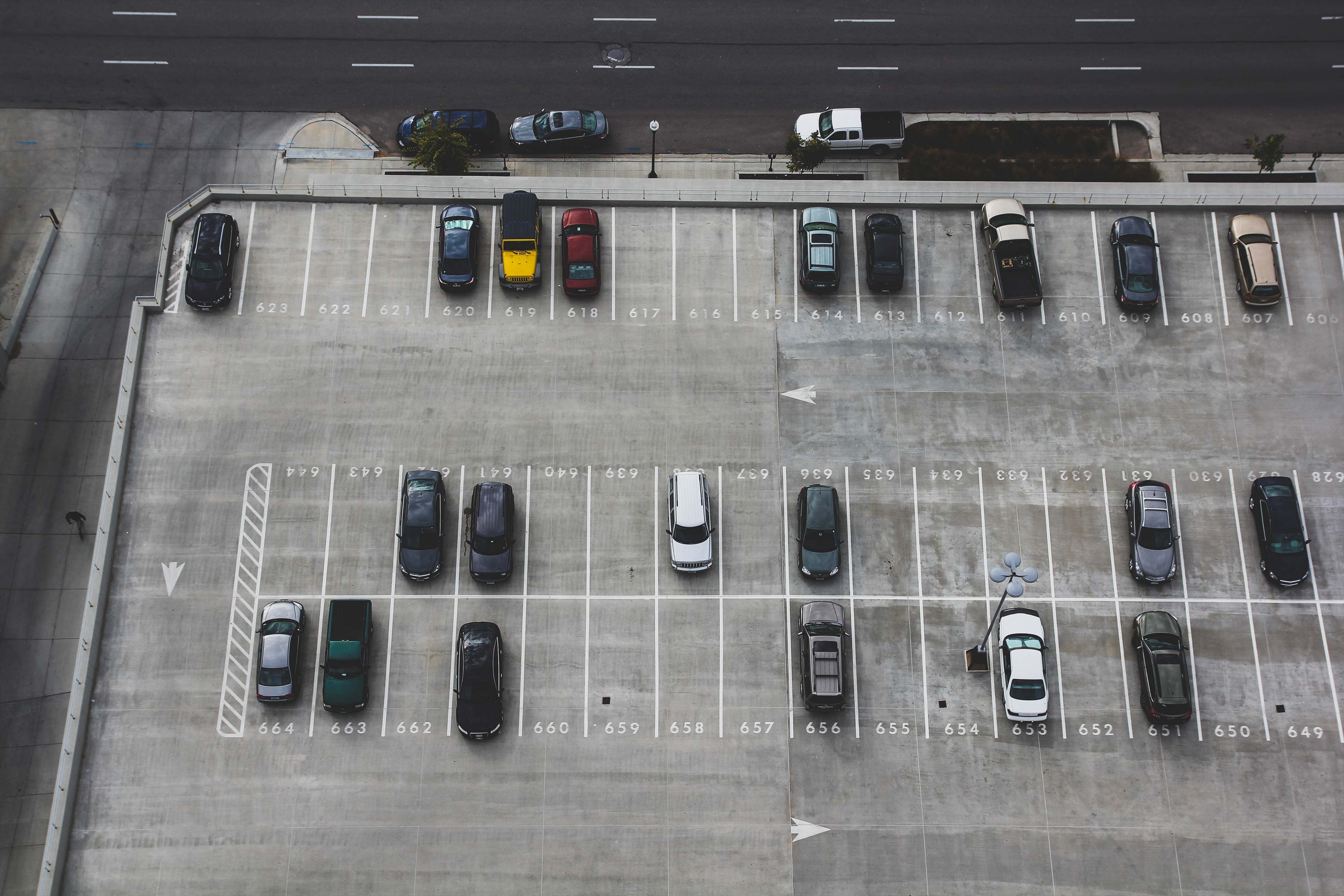

When it comes to auto usage, employees will commonly use their own vehicles in their jobs, or to run an errand for their employer.

If there is an accident, does your company have protection if it and your employee is sued? Just because your company has a business auto policy, it does not mean that the coverage is there. You would need to make sure that it has coverage for "non-owned" automobiles. This is coverage for autos which are not owned by the company, but, used for business. A misconception is that business auto is only for the cars owned by the company but depending on the coverage that may not be 100% true.

Business Auto insurance at its core only covers employees while operating a vehicle owned by the company preforming business tasks. Most of the employees auto policies will EXCLUDE business use and there may be a gap in coverage. This can be rectified by the employers commercial auto policy being amended to cover non-owned vehicles.

Something else to consider is if the amount of non-owned coverage is enough. The auto liability limits need to be high enough to protect all parties (business and employee). It is also important to note that the liability limits will be for the business NOT the employee.

In the case that the company does not own any vehicles, it is possible to purchase commercial auto liability coverage for only the danger of loss involving the use of "hired and non-owned" vehicles. "Hired" would cover business travel and vehicle rentals, whereas the non-owned would cover cars owned the employees (for business use).

In cases where businesses rarely ever use non-owned autos, all it takes is a serious accident to create a serious loss for the business.

Resources

We can help with any of your insurance needs, providing personal, commercial, life, and health insurance policies and advice.

Get a QuoteGet in Touch

Contact Us

Phone: (714) 526-5588

Fax: (714) 526-4487

Email: info@williamsinsurance.com

Our Location

609 N. Harbor Blvd.

Fullerton, CA 92832