What you should know about older homes in the US.

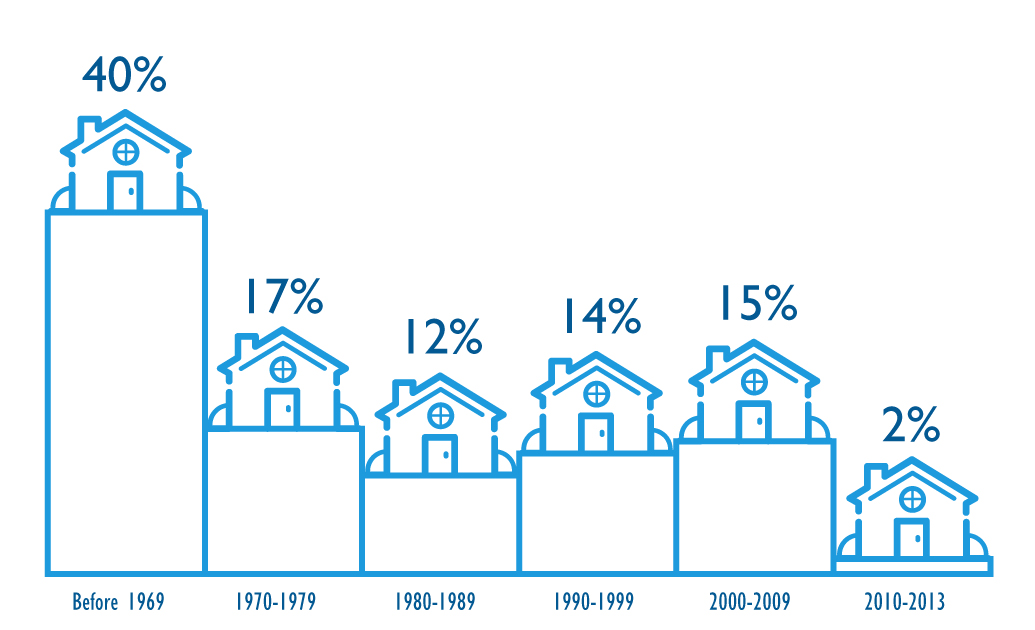

Homes make up one of the largest types of coverage provided by insurance companies in the U.S. Per U.S. Census Bureau figures (as of 2013). The age composition of owner-occupied homes varies from state to state, but nationally it breaks down as follows:

As of 2013,

nearly half of all homes owned and occupied in the US were built prior to 1969.

The Age of Occupied Homes in the U.S. by Decade Built

As of September 2020, there are approximately 190 million homes in the U.S. 14% (27 million) of these homes are between 11 and 20 years old, and 20% (37 million) of the homes are over the age of 70. The average home age differs considerably across the U.S., with the lowest average age in the West and the highest in the Northeast. Many older homes are, for the most part, readily insurable with issues. However, significantly aged homes, roughly 70 years or older, can create many issues for insurers providing coverage for these homes.

Homes constructed prior to the 1920s may have architectural features that are very difficult and costly to repair. Many of these homes have historical local value. The repairs may also be restricted by local municipality ordinances which dictate how the repairs are to be made. For example, some cities require homes that have been designated as historic use similar materials when repairing, such as in facades, architectural features, and eve windows. These homes make up about 7% (13 million) of homes. This may make it necessary to get insurance coverage on a different claims settlement basis, such as functional or repair cost protection. The result is that owners of older homes must bear more of the risk and expense of losses that occur.

When dealing with older homes, there are a variety of problems that may arise, such as the following:

Asbestos & Hazardous Building Materials

Some homes may contain hazardous materials such as lead in paint or asbestos flooring or insulation, especially in home built between the 1940s and 1970s when asbestos use in homes was at its peak.

Insects & Termites

Possibility of insect damage such as termites; older, wooden structure in southern part of the country are far more vulnerable, as insect activity occurs year-round.

Mold & Mildew Damage

due to older homes being exposed longer to the effects of moisture, including from older plumbing fixtures.

Plumbing Problems

significant damage can occur if a plumbing system is aged, making leaks and burst pipes possible due to clogs, deterioration and root damage.

Foundation or Structural Problems

A variety of problems can occur due to deterioration, shifting and settling. Cracked foundations, floors, walls and damage to home openings become common and ineligible for coverage.

Roof Damage and Leaking

Older homes can often have old, deteriorating roofs. Such roofs may suffer from water damage, damage to insulation and drywall and even vermin infestation. All are ineligible for coverage as they are maintenance issues.

Outdated Single-Paned Windows

These are endemic to older homes, creating huge bills due to air leaks.

Deteriorating Electrical Systems

Older homes face significantly higher exposure to loss caused by obsolete electrical systems, such as increased fire hazard from exposed wires or circuits that may blow or overheat.

Older Heating Appliances

These can present higher likelihood of interior flooding from burst appliance connections or winter pipe freezing because of furnace failure and other problems.

Deteriorating Flooring & Walls

Older homes may have physical features such as uneven flooring, unusual entries or stairs or partial walls and off-centered supports left over from previous tenants over the years. These could lead to increased hazards to residents and visitors if uncorrected.

Speak with one of our Williams Insurance experts should you have any questions about your home or you are considering purchasing a home that is older

.Request a Free Quote Today!

Our team is ready to help you.

Resources

We can help with any of your insurance needs, providing personal, commercial, life, and health insurance policies and advice.

Get a QuoteGet in Touch

Contact Us

Phone: (714) 526-5588

Fax: (714) 526-4487

Email: info@williamsinsurance.com

Our Location

609 N. Harbor Blvd.

Fullerton, CA 92832